Basically, a credit score is a numerical expression that represents the creditworthiness of an individual. It’s based on level analysis of credit files from credit bureaus.

Payment history

Having a good payment history is one of the most important factors in calculating a credit score. When a credit bureau calculates a credit score, it takes into account the number of late payments, delinquent accounts, and available credit.

A strong payment history increases your odds of getting a low interest rate. Creditors use a credit score to determine whether or not they should give you a loan. Those with a poor payment history are viewed as high-risk borrowers.

Paying your bills on time is the best way to improve your payment history. If you find that you are consistently making late payments, try setting up automatic payments or creating a budget. You will also want to start paying down your credit card balances.

When you miss a payment, it will be reported to the credit bureaus. This information can be damaging for your credit, especially if you are more than 30 days late. The more recent the late payment is, the higher it is ranked on your credit report.

Creditors usually report payment history to the three major credit bureaus. These bureaus include Equifax, TransUnion, and Experian. Each of these bureaus weighs your payment history differently. If you believe that your credit history is incorrect, contact the lender or the credit bureau to dispute the information. You may be asked to provide proof.

Payment history is also important because it shows lenders that you are a reliable borrower. Those with a poor payment history may have trouble getting a loan or credit card.

Having a credit card or line of credit can be a great way to boost your credit score. However, you must pay your bills on time to maintain a high score.

Credit utilization rate

Having a high credit utilization ratio isn’t a good thing. It can hurt your score, and it may indicate that you aren’t taking good care of your money.

The good news is that you can improve your credit utilization ratio in several ways. The first is by paying off your credit card bills early. You can do this by making a couple of small payments each month or by transferring your balances from one card to another.

The next is by using your card’s internet portal to check your credit score. This is a good way to see how you are doing, and you can use this information to improve your credit score.

The credit card company will also update your balance information at the end of each billing cycle. You can check your credit limit online or by calling the company. You will also want to consider the number of cards you have. If you have more than one credit card, consider which ones are best for your financial situation.

Finally, pay off your large purchases as soon as possible. This will lower your credit utilization ratio, and it will also help prevent your credit score from slipping.

The credit utilization ratio is not only important for your credit score, it’s also important for your personal financial situation. If you have high credit utilization ratios, you may be at a higher risk for defaulting on your payments. This may result in you being declined for a loan, and you could lose money. This is because high credit utilization is a warning sign that you may be unable to pay your debts.

The credit utilization rate is just one of the many factors used to determine your credit score. There are other factors, like your credit history and the number of credit cards you have, that also factor into your score. The FICO(R) Score recommends keeping your total credit utilization below 30%.

Age of credit accounts

Having an average credit age of at least 5 years can give your credit score a boost. However, it’s important to remember that it’s not the only factor that impacts your score. The payment history and credit utilization ratio are also important.

Credit scoring models calculate credit age by looking at the average age of all your credit accounts. The ages of your cards are added together, and then divided by the total number of credit cards. A low average age indicates that you are often applying for credit. It also suggests that you might be having trouble managing money without credit.

The longer your credit history, the better. This means that a good repayment history can help you to get the best interest rates. However, if you have a bad payment history, it can hurt your score even if you have a long history.

Credit scoring models calculate the length of your credit history by looking at the age of your oldest account and the age of your newest account. These two factors account for 15% of your FICO score.

While age isn’t the only factor that affects your score, it’s important to remember that it’s a key factor. Keeping balances low and making payments on time are two ways to build a positive payment history.

Opening a new credit product, like a new credit card, is a good way to reduce your average age. However, it’s important to be careful with these new accounts. It’s also a good idea to diversify your credit types. That way, you won’t be overspending and reducing your average age at the same time.

Keeping your credit utilization ratio low will also help you to maintain a good credit score. You want to pay your bills on time to show lenders that you’re responsible with your money.

Multiple credit scores

Having multiple credit scores can be a confusing and frustrating experience. Thankfully, there is plenty of information to help you understand what’s happening and how you can improve your credit score.

Credit scores are important because they help lenders determine your credit risk. They help you get better terms and rates on loans, and they are also used by certain employers when evaluating job applicants. They are also used by landlords to vet tenants.

Credit scores are based on information provided by the three major credit bureaus, including Equifax, TransUnion, and Experian. These credit bureaus each gather information independently, so if one of them misses an important piece of information, the information could be missing from your score.

Credit scores are based on a variety of factors, such as how old your accounts are, your payment history, and how many inquiries you’ve had. The length of your credit history is also important, as lenders want to know how long you’ve had credit.

Another factor that can affect your credit score is the credit scoring model used by the lender. Different companies may have different scoring models. One scoring company may focus more on your payment history, while another may focus on the mix of your credit accounts.

Some lenders are still using a credit scoring model that was in place in the 1990s. The Federal Housing Finance Agency is currently considering whether it’s time to update the scoring model.

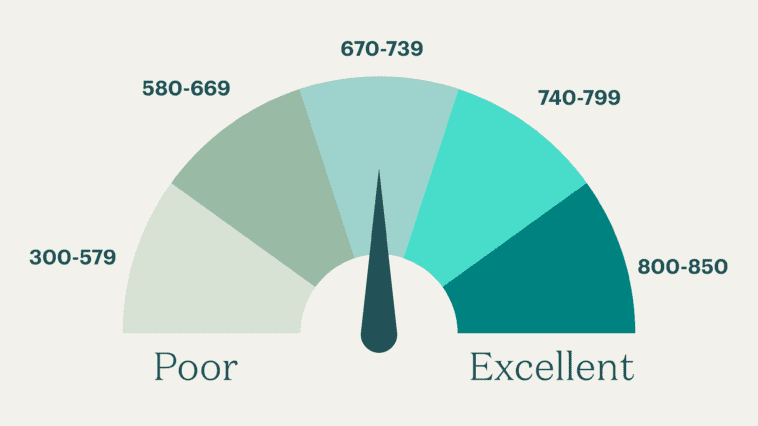

One of the most commonly used credit scores is the FICO Score. The Fair Isaac Corporation (FICO) produces scores for 49 different credit types. A FICO score ranges from 300 to 850. FICO produces scores for mortgages, auto loans, credit cards, personal loans, student loans, and more.

Effects of new credit applications

Whether you’re a seasoned credit card user or you’re just looking to start building a credit history, it’s important to understand the effects of new credit applications on your credit score. These applications will trigger a “new credit” category in your report. This category contains your credit card applications, auto loans, and mortgages. It is one of the five most important factors in calculating your FICO score.

The effects of new credit applications on your credit score can be small or dramatic. They vary depending on the credit scoring model you use. However, new credit accounts will typically have less of an impact than truly negative items.

While new applications will not necessarily hurt your credit score immediately, they will have a brief impact. This is because new credit accounts lower the average age of your accounts. The longer you have a credit history, the less risk you represent to lenders.

In general, applying for too many cards in a short period of time will have a bigger impact on your score than applying for a single card. If you’re planning on applying for a mortgage or a car loan, be sure to give yourself enough time to review your options. If you’re just looking to open a few cards, you may be able to get them with prequalification forms.

While a new application may reduce your score by a few points, there is a lot of upside to acquiring new credit. You may be able to increase your credit limit, boost your credit mix, and gain access to better rates.

Depending on your credit history, your credit score may also take into account the number of new accounts you have. The length of time since you opened a new account is also considered. The FICO score also takes into account your total amount owed and payment history.